A Cheap Valuation

Peabody Energy earned a free cash flow (Operating cash flow - CAPEX) of $1.2 billion in 2018 and $407 million for the first nine months of 2019. The company’s market cap is around $900 million, and it only has $570 million in net debt. This means that the company is trading for less than 2x cash flow with a very manageable debt load. The company also has around $4.9 billion in PP&E (mostly coal deposits). Once again, for a company valued at $900 million, the shares seem significantly underpriced for the tangible assets and future cash flow stream.A Prudent Policy of Returning Capital to Shareholders

The company has been plowing its free cash flow (FCF) almost entirely into both dividends and share buybacks. In fact, since emerging from bankruptcy in 2017, the company has bought back around 30% of its shares outstanding. Not bad considering the company’s debt remains unchanged. Other analysts are criticizing the company’s buybacks as “failed” because the stock continues to decline in price. However, the objective of share buybacks is not to prop up the price of the stock in the short term, but to increase the FCF per share in the long term (which will lead to massive dividend payments in the future). I hope the company continues to buy back as much stock as it can at these prices in order to increase long term returns for shareholders.Why are the shares so cheap?

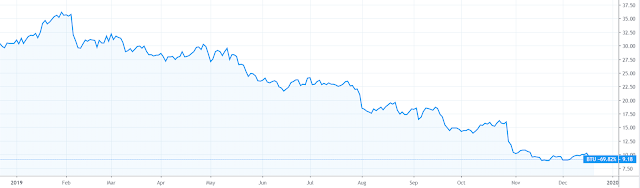

Peabody’s share price has had a rough year to say the least. |

| 52 week range of $8.65 - $37.37; currently $9.15 |

The sell-off is likely due to two reasons: a declining FCF and a botched debt offering.

Although the company has produced incredible cash flow in the past couple of years since coming out of bankruptcy, the company only had $92 million of FCF in the most recent quarter. This was due largely to unfavorable pricing in coal. If a company such as Coca-Cola or Visa reported a major decline in profitability for a few quarters, investors would be justified in being alarmed as it demonstrates that the company’s economic moat might be eroding. But for a company such as Peabody, where its profitability is sensitive to commodity pricing, a decline in profitability is not indicative of any long-term issues. Commodity prices move more or less randomly in the short-run, and we are currently experiencing a short-term decline in coal pricing. Even if share prices were to become more unfavorable, Peabody would be able to weather the storm with its clean balance sheet, and patient investors will be rewarded.

As for the botched debt offering, in early September Peabody announced that it would refinance its debt by issuing $900 million in bonds to pay off earlier maturing debt. However, on September 19, the company announced that it would no longer refinance its debt because the bond markets would “not accommodate a path toward completing the offers and achieving the company's refinancing objectives in an economic fashion”. That is, nobody wanted to purchase Peabody’s bonds. The stock fell 8.1% the next day.

Some analysts took this event as a message that the omniscient market sees a special risk in this stock. That even with a clean balance sheet and great cash flow, the company is too risky to even invest in its senior secured bonds. In a world starving for yield and willing to invest in the riskiest of projects, this story doesn’t make sense. Below is what I believe is happening.

A Market Overreaction

Peabody has all the red flags needed for institutional investors to turn and run the other way:1. Relatively recent emergence from bankruptcy

2. Sub-$1 billion market capitalization

3. Primary business in one of the most politically hated industries

These issues are a deal-breaker for a large institutional fund with strict rules and regulations, which is leading to a significant mispricing of the firm. Fortunately, you (probably) don't have the same narrow guidelines and have the ability to potentially buy into a company that trades for around 2x FCF.

In addition, I believe the reason retail investors are not buying the stock is because coal companies have been a losing investment for the past decade. The industry had been operating with high levels of debt and unpredictable cash flows due to commodity pricing. However, Peabody has managed to shed its $10.1 billion in debt and is now in great financial shape, which the market still hasn’t fully appreciated. The company only spends around $142 million each year on interest payments, nowhere near the level needed to threaten bankruptcy or the payout to shareholders.

The Catalyst

Investors can make a return on the investment in two ways: the first is from a change of sentiment, and the second is from a return of capital to shareholders. Change of sentiment is a bit unpredictable but does happen frequently. From time to time industries such as tobacco, banking, and energy oscillate between extreme overvaluation and undervaluation. It's impossible to precisely time the change in market attitude, but buying a company in an atmosphere of extreme negativity can present an opportunity to profit once the market sentiment reverts.The main catalyst in Peabody is the return of capital to shareholders. The cash provided from operations is almost entirely being returned to shareholders in the form of buybacks and dividends (which will only increase as the buybacks continue). By holding onto Peabody's shares for the long-term, investors should expect significant future dividends even if the price stays the same. The company's huge coal reserves, low debt, and strong cash flow will prevent the price from falling to a level that permanently destroys an investor's principal.

Risks and Other Thoughts

I would like to note that Peabody had a negative net income for the quarter of $0.81. This means that a large portion of the FCF is coming from the liquidation of inventory (coal deposits) at a slight loss. Although this has not been the pattern for the past few quarters (and I do not have the ability to predict where the price of coal is heading), it is certainly a concerning development.

However, the company has a net $4.172 billion of land and coal interests on its balance sheet. This means that even if the coal is being sold at a slight loss, the company would free up around $4 billion in cash for shareholders. Once again, this is while the market capitalization of the company is around $900 million, and the enterprise value is around $1.5 billion. The amount of coal on the balance sheet provides a margin of safety against further declines in the price of coal, which is a luxury that other coal companies may not have.

Finally, the largest risk to Peabody is the termination of coal from energy generation globally. However, I believe this risk is overblown as the International Energy Agency estimates that global coal consumption will remain steady through 2024. It's hard to quantify the probability of a sharp decline in coal-based energy generation globally, or the probability of future legislation banning the mining of coal; however, I believe investors generally overreact to potential adverse regulation. One of the best performing stocks a person could have owned the past 50 years is Altria. The reason is not because smoking has been increasing in popularity, but rather the opposite. Altria was able to reinvest its cash flows via stock buybacks and dividends at cheap valuations to boost returns. I'm not suggesting that Peabody will have the same returns as Altria going forward, but I do believe the company will produce satisfactory returns at the current valuation.

No comments:

Post a Comment